If you've been looking at Bank owned properties in the $400,000 - $500,000 price range in King County, have you found there are few to choose from? Did you know there are only 31?

The same price range in Snohomish County will offer you a whopping 18.

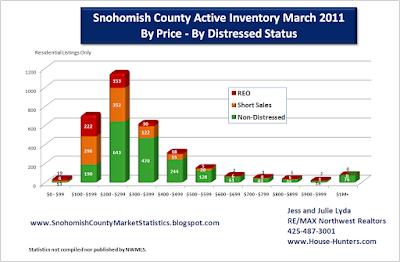

You might say "wait, but where are all the foreclosures we read about in the media?"

Well, they are out there, but unless you are looking for a "fixer upper" under $200,000 the choices will be few.

Click on graphs to enlarge.

When we look at the current inventory of distressed properties in King County, we have found that most fall under $300,000. As a matter of fact, 76% of all the active listings under $200k are distressed property listings which include short sales.

Distressed properties are defined as bank owned (REO) properties and short sales (home owners who owe more on their mortgage than the current listing price).

Now we're not saying you can't find that diamond in the rough, but if you're looking to buy a great bank owned property, you're mostly likely just going to find the "rough". But there are some definate bargins to be found!

Checking bank owned homes in Seattle under $300,000 there are only 126 out of 586 in King County. That means that a majority of them are in outlining areas such as Renton & Federal Way. Here's a sampling of bank owned inventory under $300K by area:

White Center Area = 31

West Seattle =40

South Seattle/Rainier = 34

Beacon Hill = 8

North of Lake Union = 11

Even with all the headlines about foreclosures these days, we are finding that the banks are changing their tune regarding foreclosures. We know there are many who are struggling to meet their mortgage payments, but we also see banks pushing through more home loan modifications and starting to approve short sales quicker.

Even with all the headlines about foreclosures these days, we are finding that the banks are changing their tune regarding foreclosures. We know there are many who are struggling to meet their mortgage payments, but we also see banks pushing through more home loan modifications and starting to approve short sales quicker.

Short sale properties can be a good buy, but few are willing to wait the 4 months it takes to get an offer approved. So until that process is streamlined by the banks, we don't see a rush to short sale purchases.

For 2010 we see that in King County 15% of closed sales were bank owned properties and 10% were short sales. So keep in mind that 75% of all home sales for 2010 were non-distressed home transactions. See graphs in right hand column for distressed properties sales for 2010.

For 2010 we see that in King County 15% of closed sales were bank owned properties and 10% were short sales. So keep in mind that 75% of all home sales for 2010 were non-distressed home transactions. See graphs in right hand column for distressed properties sales for 2010.

We continue to watch the trends, stay tuned for monthly updated charts on foreclosure and short sale stats.

4 comments:

Jesse and Julie, good job on your blog! - Jerry Buccola

most properties that goes up for auction don't ever get bought, so where are they going? seems like these numbers should be higher (not doubting them, just confused).

Gerg,

The properties go back to the bank and ultimately get listed on the market with a real estate company. Currently there are about 1,200 bank owned properties on the market in King County.

If you check the graph under King County Absorption Rates you will see how many have been foreclosed and listed & sold for the last 12 months.

Current sales are absorbing about 75% of the bank owned properties so there isn't a huge inventory of active bank owned listings.

The purpose of this article was to point out that most of the foreclosed properties were under $300K.

Let me know if you have any more questions.

Yeah, good post (even though I'm a little late) but I had another thought on how these stats are laid out. Perhaps all the foreclosures above a certain price point are immediately passed to a real estate agent whereas banks try to hand lower priced foreclosures internally? Maybe the bank is trying to save money on the less expensive properties?

Seattle Homes

Seattle Condos

Post a Comment