Jess and Julie Lyda ~ RE/MAX Northwest Realtors ~ Local Market Experts For 26 Years ~ 425-487-3001

Monday, November 9, 2009

BREAKING NEWS ! New Expanded Home Buyer Tax Credit Approved

Qualifying purchasers can receive a credit up to $6,500.

The income limit for singles is $125,000 and $225,000 for married couples. If your income is higher than that, you can still qualify, but the credit will be less.

The credit can be applied to home purchases up to $800,000 and is effective on purchases until April 30, 2010 (must close escrow before 7/1/09).

With home prices finally stabilizing, now is a great time to take advantage of lower home prices and lower interest rates!

Friday, October 16, 2009

Snohomish County Residential Average Sales Prices Hold Steady

King County Foreclosure Rates 2007 Through September 2009

The foreclosure rate for September in King County rose slightly over August. Foreclosure rates remain high overall but show signs of recovery as August and September are the 2 lowest foreclosure notice filing months posted so far this year. We hope the trend continues as the market continues to show show signs of stabilization.

The foreclosure rate for September in King County rose slightly over August. Foreclosure rates remain high overall but show signs of recovery as August and September are the 2 lowest foreclosure notice filing months posted so far this year. We hope the trend continues as the market continues to show show signs of stabilization.

Everett Condo Annual Sales Prices for 2004 - 2009

The sales numbers of resale condos in Everett has bounced around a bit during the year. Average monthly sales prices can be swayed easily by one or two high or low priced sales. The chart below shows a more reliable annual average for median condo prices.

The sales numbers of resale condos in Everett has bounced around a bit during the year. Average monthly sales prices can be swayed easily by one or two high or low priced sales. The chart below shows a more reliable annual average for median condo prices. These statistics only include condominiums that are at least 5 years old. The numbers tell us that on avereage, resale condo prices have come down to 2006 prices or about 15% on average since peaking in 2007 at $204,950.

These statistics only include condominiums that are at least 5 years old. The numbers tell us that on avereage, resale condo prices have come down to 2006 prices or about 15% on average since peaking in 2007 at $204,950.Wednesday, September 2, 2009

FORECLOSURE NOTICES DROP 50% FOR AUGUST 2009

Not all of those are your "typical family" losing their home. That number represents investors, speculators, home builders and flippers. Taking a guess, I would imagine about only 50% of that number represents a typical family losing their home.

The King County census records indicate that 59.8% (from 2000 - the current number for 2008 would be higher, but that info is not available) of 816,764 households, are homeowners. That gives us 2,247 of 488,425 homes lost through foreclosure this year, representing only .0046%.

Sounds like a pretty low number compared to what we read and hear in the media. Our local real estate market is not even close to the turmoil of markets in other states.

Actually, we are holding up fairly well when we look at the big picture!

Monday, July 13, 2009

Snohomish County Homes Prices Show Stabilization

Wednesday, July 1, 2009

The Notices of Trustee Sales jumped significantly for June of 2009. Actual foreclosures based on filings 90 days ago represent 29%, down from 31% for May. If we expect that 30% of filings turn into actual foreclosures 90 days later, we could predict that there will be about 485 actual foreclosures filed in September, which would be the highest on record. Only time will tell us if the banks are making any progress in getting through the backlog of loan modifications. Banks have informed us that it is taking 4 - 6 months to complete loan modifications.

Tuesday, June 16, 2009

Snohomish County Average Home Prices May 2009

Monday, June 1, 2009

King County Foreclosure Rates May 2009

Tuesday, May 5, 2009

Snohomish County Homes Sales By Price Through April 2009

Snohomish County homes sales are weighted heavily in the $200k - $400k price range. The market for the over $500K home remains anemic.

Snohomish County homes sales are weighted heavily in the $200k - $400k price range. The market for the over $500K home remains anemic.This is having an effect on the average and median home price charts.

This does not necessarily mean prices are continuing to fall in Snohomish County. The charts and graphs reflect the numbers from "homes that are currently selling".

Snohomish County Average Home Prices April 2009

King County Foreclosures Notices Drop in April 2009

Friday, April 24, 2009

Distressed Properties Are Being Snatched Up in Snohomish County!

Distressed properties sales represent a big chunk of the current sales because they can be purchased at very reduced prices and some are selling quickly.

January through March shows 334 foreclosures, of which 144 were snatched up at auctions or sold on the open market leaving a net of 190 homes left to sell, of which most are currently on the market either in active or pending status. This also shows that banks are not holding back on putting foreclosed properties on the market. Also, providing further evidence that banks are now looking to modify loans rather than resort to foreclosure.

The foreclosure process can add additional costs of more than 10% of the price of the home. Coupled with heavily discounting the property at auction.

Not surprisingly, a majority of foreclosures are found in out-lining areas, hardest hit by lower income home buyers. As you move closer in to Everett, Mill Creek and Bothell communities, the rates go down. The Marysville, Stanwood and Arlington areas have been hit the hardest, with south Snohomish County in Bothell and Woodinville holding up pretty well.

Areas:

610 = South Snohomish County: Bothell, Canyon Park, Woodinville

730 = Lynnwood, Edmonds, Brier, Mountlake Terrace

740 = Mukilteo, Everett, Mill Creek

750 = Sultan, Gold Bar, Index

760 = Granite Falls, Darrington

770 = Marysville, Arlington, Stanwood

Through April 24th there are 133 foreclosures filed vs. 203 for the month of March for King County. For Snohomish County there are 76 foreclosures filed vs 106 for the month of March.

Additional evidence to this fact is that Notice of Trustee sale filings (mortgages in default) are also falling. For King County through 4/23 there are 728 filings vs. 1089 for the month of March. And Snohomish County shows 351 vs 499 for the month of March. Unless there is a huge spike in filings in the next last 4 days of the month total numbers should be down.

New graphs for April will be posted the 1st week in May.

Thursday, April 23, 2009

Monday, April 6, 2009

Snohomish County Home Prices up 3.75% From January 2009

Click on picture to enlarge.

Click on picture to enlarge.Snohomish County home prices have risen February and March after 5 straight months of decline and 22 months since prices peaked in March 2007.

Two months of data is not long enough to predict a trend - but it does tell us that home prices have stopped diving off the cliff.

There is still downward pressure on average home sale price data.

Does this mean that home prices are still falling? NO. This just means that there are more sales in the lower price ranges which drags down the average number for all.

Homes that are price right are selling in under 30 days, while those that are still overpriced languish on the market.

King County Foreclosure Rates March 2009

A curious thing happened last month. Even though Notice of Trustee Sale filings have risen, the actual homes that were foreclosed on went down.

To understand this we must look at 4 months prior, which would be November, where Notice of Trustee Sale filings dropped slightly. It is important to know that once a Notice of Trustee's Sale is filed it will take four months to turn into an actual foreclosure.

Now look at the increase of Notice filings for January, February and March. Will the increase in filings turn into foreclosures for April, May and June? We'll have to wait until May 1st to see.

Wednesday, March 18, 2009

Breaking News: Interest Rates to Drop Near 4%

The Truth About the Seattle Area Foreclosure Rates - Exposing the Real Numbers

For Immediate Release:

The foreclosure market in the Puget Sound area has been way over-hyped. This first article, in a series of articles, is about King and Snohomish County foreclosure rates.

Whatever happened to fact checking? When a company or corporation publishes statistics, who’s checking up on the real facts? Who’s digging through the real numbers to check their validity?

A very timely topic considering the on-air sparring between Jon Stewart of Comedy Central and Jim Cramer of CNBC.

When it comes to housing numbers, consider me a watchdog.

RealtyTrac, one of the nation’s leading sources of foreclosures statistics, and commonly used by the media, produces data that is seriously flawed and skewed for their own financial benefit. They are misleading the entire country. A quick Google search will reveal communities across the country who have called them on the misleading data and they choose not to change the way they report the numbers.

Also, newspaper and television media use their numbers, because they have no other reliable sources to use for foreclosure data. So I started checking the numbers myself and was startled at what I found.

There is no argument that foreclosures are on the rise. But RealtyTrac is overstating the numbers in our area by 75%.

The actual numbers paint a very different picture. So when you read the front page of the paper or see on the evening news that hundreds are losing their homes to foreclosure every day in the Seattle area, don’t believe what you hear. That may be happening in other parts of the country, but not here in the Puget Sound area.

RealtyTrac reports only on homes that have received a Notice of Trustee’s Sale. This is a document filed when someone is usually at least 90 days late on their mortgage payment. What Realtytrac doesn’t tell you is that only 28% of these will turn into an actual foreclosure.

As published by Realtytrac for February 2009:

The first problem is Realtytrac reports 971 homes in foreclosure for February, however research of the of the King County Recorder’s office shows the real number to be 838.

Second, Realtytrac fails to account for Discontinuances of Notice of Trustee Sales which numbered 174. These are notices that have been canceled, meaning the homeowner cured the default.

That brings the net to 664, not the 971 they reported. The actual number is 34% lower than what they reported. And let’s not forget that this number only represents “people who are late on their mortgage payments”. Not actual foreclosures.

Thirdly, and most importantly Realtytrac fails to account for actual Trustee Deed filings, which are the deeds filed upon actual foreclosure.

A check of those numbers for February would tell you that number is 233.

What is wrong with this picture?

It’s simple, Realtytrac is a for profit website selling paid subscriptions for the public to find perceived foreclosure homes and a portal to sell internet advertising. The more sensationalized the numbers, the more traffic they can steer to their website and it’s advertisers.

They are not independent economists forecasting trends based on factual numbers. I have some serious issues with this because it thrives on the emotional fear of the public to drive traffic to their website for profit. It benefits them to inflate the numbers.

On average Notices turn into foreclosures about 28%. That is over a 70% success rate of stopping foreclosure. That statistic has been consistent for the last 10 years. Snohomish County conversion rates have jumped higher over the last two years from an average of 25% to 44%. Snohomish County Foreclosures averages 119 per month for 2008.

Many are finding ways to save their home. Some refinance, some borrow money from family or friends, some modify their mortgages and others sell. There are some who will argue that this is just delaying the problem and that ultimately these people will end up in foreclosure.

Statistics show that 55% of all modified loans in the third quarter of 2008 were in re-default at the five month mark, up from 49% reported for the first quarter. However, a typical modification only delayed payments, reinstated the loan, and most importantly provided no monthly financial relief to the homeowner. Source: OCC and OTS Mortgage Metrics Report, Third Quarter 2008.

The Modification Game Has Changed

We now have Obama’s Home Mortgage Plan. Not only are late payments being forgiven, but interest rates and monthly payment amounts are coming down in line to match the income of the borrower. Modifications were not done this way in the past.

Recovery won't happen everywhere at once. If you pay too close attention to the national numbers, you'll miss the opportunities that will start to appear locally.

Now lets look at the numbers and see what they tell us.

1. The foreclosure rate has remained steady at around 230 per month since peaking in October 2008 with 294.

2. There is a four month delay between the Notice of Sale and Foreclosures statistics. Meaning that when you see a drop in Notices, you will see a drop in Foreclosures 4 months later.

What the numbers don’t tell us.

1. What affect will the new Obama Home Mortgage Plan on foreclosures.

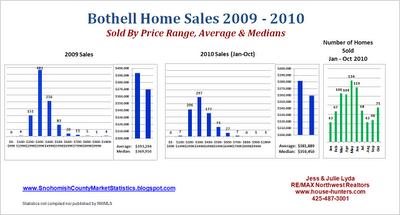

2. Short sales are not included in these numbers. My market study for Bothell properties on the NWMLS indicates that 35% of the active listings are short sales and 4% represent REO (foreclosed properties).

What questions the numbers create.

1. Notices dropped in February – does that forecast a drop in foreclosures for June? But we won’t be able to analyze that data until July 1st.

2. Will foreclosures go up until then, as Notices have risen for the months of January and February over December?

I think it’s foolish for anyone to be forecasting which direction the housing market is going with the upheaval in the unemployment numbers and the stock market. At this point all we can do is follow the statistics and over a period of time watch for any consistent improvement in the numbers.

With the past history of statistics, we will now be able to see if Obama’s stimulus plan has any affect on future numbers.

Keeping things in perspective: The Department of Treasury reports that 91% of homeowners are still current on their mortgage payment.

Sources: King County Records, RealtyTrac.com, Department of Treasury, Snohomish County Auditor.

Upcoming articles: Recovery of the Market, Bothell Statistics, The True Value of a Home.