Jess and Julie Lyda ~ RE/MAX Northwest Realtors ~ Local Market Experts For 26 Years ~ 425-487-3001

Thursday, December 2, 2010

King County and Snohomish County Foreclosure Rates for November 2010

Monday, October 18, 2010

Predatory Lending is THE Cause For Systemic Mortgage Defaults and Foreclosures

Ask yourself this question: Why are the banks foreclosing so quickly on struggling homeowners?

Why the rush to foreclose on millions and millions of families?

We have already gone through 1.5 million foreclosures and look what it has done for the economy.

These numbers might shock you. But you need to know.

Currently there are 7 million homeowners in default and in some stage of foreclosure. There are 2.3 million more that are late on the mortgage payments.

Defaults are rising 200,000 per month.

Shortly we will have 10 million homeowners in foreclosure.

This is a systemic failure of the entire banking system and we need to dig deeper to see what caused it in the first place if we have any hope of coming up with solutions.

We don't have 10 million irresponsible families. We have 10 millions victims. Victims of predatory lending that ultimately crashed the economy and jobs.

It started with the sub-prime, Atl-A, and Pic a payment loans. All predatory products.

There are 7.5 million sub-prime loans.

Why were these predatory loans made available?

Answer: Demand from investors looking to buy mortgage back securities.

And before you call the next guy a deadbeat for not paying his mortgage or say he was stupid to get a loan that he couldn't afford.... I suggest you read and watch what I have to share with you.

And before you give up on this long blog - There is a solution to this mess at the end!

This is one of the most important videos you can watch:

WILLIAM BLACK PBS INTERVIEW ON MORTGAGE FRAUD:

"The Fed had unique authority. And it had it since 1994 to regulate every single mortgage lender in America. And you might think that the Fed would use that authority. And you might especially think that, if you knew that Gramlich, one of the Fed members, went personally to Alan Greenspan and said, there's a housing bubble. And there's a terrible crisis in non-prime. We need to send the examiners in. We need to use our regulatory authority. And Greenspan refused.

Lehman was brought down primarily by selling liar's loans. It was the biggest seller of liar's loans in the world. And when we look at these liar's loans, we find 90% fraud. 90 percent, and we find that most of the frauds are not induced by the borrower, but they're overwhelmingly done by the loan brokers"

AMERIQUEST - ANOTHER STORY OF MASSIVE FRAUD IN LENDING PRACTICES

In February 2005, reporters Michael Hudson and Scott Reckard broke a story in the LA Times about "boiler room" sales tactics at Ameriquest. Their investigation found evidence that the lender had various questionable practices, including "deceiving borrowers about the terms of their loans, forging documents, falsifying appraisals and fabricating borrowers' income to qualify them for loans they couldn't afford."

Former employees from Ameriquest, which was the leading wholesale lender, described a system in which they were pushed to falsify documents on bad mortgages and then sell them to Wall Street banks eager to make fast profits. There is growing evidence that such mortgage fraud may be at the heart of the entire Financial Crisis.

http://www.npr.org/templates/story/story.php?storyId=10165859

INTERVIEW WITH AMERIQUEST LOAN OFFICERS:

ARNOLD: Russum says managers encourgaged loan officers to conceal the actual costs and interest rates on loans. He says the bulk of these subprime loans that the company was selling adjusted sharply upwards after two years. The payments would then rise by hundreds of dollars a month.

MR RUSSUM: Let's say the borrower said to the loan officer, the account executive, I don't like the fact that this is only fixed for two years. And the branch manager would come back to him and say, listen, you need to tell these guys it's fixed for as long as they need it to be.

ARNOLD: Even though, Russum says, that wasn't true. The Russum says he started seeing things that were even more over the line. Russum says he was honest with customers, but says many of his co-workers weren't. He says some would "white out" income numbers on W2's and bank statements and fill in bigger amounts basiclly to qualify people for loans they couldn't afford. That was called taking the loan to the "art department.

MR. RUSSUM: You started seeing forging of signatures on loan documentation. You started seeing a lot of bait-and-switch tactics.

ARNOLD: Russum says some loan officers would even print up fake fixed loan documents and put them on the top of the stack of papers the customer was signing at their closing.

MR. RUSSUM: Maybe the first couple of documents they saw in their package were fixed rate, and then they would slip in the adjustable rate docs at the end and then trashing the fixed-rate docs.

This interview was May 2007.

INDYMAC: WHAT WENT WRONG?

Michael Hudson, investigative reporter who wrote Merchants of Misery: How Corporate America Profits from Poverty. He is also author of The Monster: How a gang of predatory lenders and Wall Street bankers fleeced America - and spawned a global crisis which will be published in October 2010 by Times Books. The book focuses on two firms - Ameriquest Morgage and Lehman Brothers - that were key players in the rise and fall of the subprime mortgage industry.

Hudson wrote for the Center for Reponsible Lending. He found evidence that the banks had "engaged in unsound and abusive lending during the mortgage boom, routinely making loans without regard to borrowers' ability to repay." Shortly before the bank was seized by federal regulators, an IndyMac spokesman dismissed the report as a "hit piece" that "relies on unsubstantiated anecdotal evidence." The U.S Department of the Treasury inspector general's office later reported that it's invistigation indicated that IndyMac had done "little, if any, review of borrower qualifications, including income, assets and employment.

http://en.wikipedia.org/wiki/Michael_Hudson_(reporter)

PREDATORY LENDING: A DECADE OF WARNINGS

A little more than a decade ago, William Brennan foresaw the financial collapse of 2008.

As director of the Home Defense Program at the Atlanta Legal Aid Society, he watched as subprime lenders earned enorrmous profits making mortgages to people who clearly couldn't afford them.

The loans were bad for borrowers - Brennan knew that. He also knew that the loans were bad for the Wall Street investors buying up these shaky mortgages by the thousands. And he spoke up about his fears.

"I think this house of cards may tumble some day, and it will mean great losses for the investors who own stock in those companies,"

he told members of the Senate Special Committee on Aging in 1998.

It turns out that Brennan didn't know how right he was.

I HIGHLY suggest reading this website. There is a lot of info, charts and videos.

http://www.publicintegrity.org/investigations/economic_meltdown/articles/entry/1309/

SO WHY THE RUSH TO FORECLOSE?

Are the banks rushing through the foreclosures to hide the fraud that can be found in the mortgage documents? What do you think?

IS THERE A SOLUTION TO THIS MESS?

Short of a lot of lawsuits and bankers going to jail, there just may be something that can be done to save us from this catastrophe.

- We need to immediately re-write all existing mortgages with a fixed rate 4% interest rate for 30 years, regardless of credit, income, debt or loan to value.

- Roll in all missed back payments into the new mortgage and effectively "start over".

Sound like a crazy plan? Well the professors at the Columbia Business School think it can work and stimulate the economy at the same time.

Benefits of the plan include:

- Reducing mortgage payments frees up descretionary money so that people start spending again.

- The program can be implemented without costs to taxpayers.

- Minimal loan costs would be added to the new mortgage.

- Title Insurance for $250 - no appraisal, no credit.

- To fund the program, the agencies would issue new mortgage backed securities (MBS) and use the proceeds to pay off existing MBS.

- The program will help reduce the federal deficit.

- The plan will reduce foreclosures and stabilize home prices.

- This is not a subsidy or bailout.

and much, much, more.....

Read the Plan Here:

http://www4.gsb.columbia.edu/realestate/research/housingcrisis/refinancing

Thursday, October 7, 2010

Housing Crisis Hits New Low - Breaking Into Homes

Wednesday, October 6, 2010

Monday, September 27, 2010

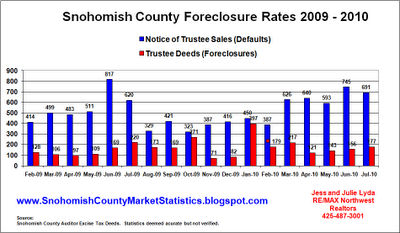

Snohomish County Foreclosure Rates August 2010

Monday, August 9, 2010

Snohomish County Foreclosure Rates July 2010

The Snohomish County foreclosure rates remain elevated for July 2010. The Notice of Trustee Sales remain near their highest levels for the year. As typical, only about 25% of the Notice of Trustee Sales turn into actual foreclosures. There are various reasons why a home won't be foreclosed on. Those could be homeowners who have entered into a loan modification, those that catch up on their late payments, and those that end up selling their home.

The Snohomish County foreclosure rates remain elevated for July 2010. The Notice of Trustee Sales remain near their highest levels for the year. As typical, only about 25% of the Notice of Trustee Sales turn into actual foreclosures. There are various reasons why a home won't be foreclosed on. Those could be homeowners who have entered into a loan modification, those that catch up on their late payments, and those that end up selling their home.Wednesday, July 14, 2010

Snohomish County Foreclosure Rates June 2010

With the HAMP program there is really no need for someone to loose their home through foreclosure. This program not only helps those that have had income reductions, it will help those that have had a job loss.

"By August 1, all mortgage servicers participating in the Making Home Affordable Program will offer extra help for homeowners struggling to make their monthly mortgage payments because of unemployment. The Unemployment Program will offer homeowner's a forbearance period to temporarily reduce or suspend their monthly mortgage payments while they seek re-employment"

If you know of someone who is struggling to meet their payments, have them give us a call. We would be more than happy to explain the Making Home Affordable Program and how it may help them stay in their home. We have already helped 2 families keep their homes after going through a home loan modification.

As Realtors, we find it is important to provide education to those in need - and we are here to help!

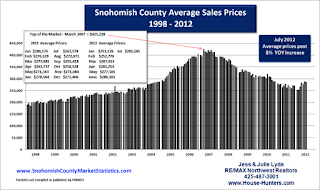

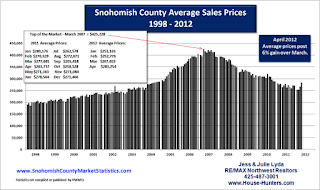

Snohomish County Average Home Prices June 2010

Distressed property sales continue to be a factor in the market. Bank sales or REO properties represent 20% of the sales and Short Sales represented 11% of the sales for the period of January to June 2010.

Monday, June 7, 2010

Snohomish County Average Sales Prices May 2010

Snohomish County average sales prices for May 2010 continue to show market stabilization. Average home price sales have been hovering around $310,000 for the last six months.

Snohomish County average sales prices for May 2010 continue to show market stabilization. Average home price sales have been hovering around $310,000 for the last six months.Distressed property sales represented 23% of the sales for May. For May there were 713 residential property sales of which 171 were distressed properties.

Bank owned properties sold for an average price of $241,757.

Short sale properties sold for an average price of $292,855.

There are many more homes in the lower price ranges that are distressed properties which is reflected in their average sales prices.

Friday, May 14, 2010

REO Sales Outpace Foreclosures in Snohomish County

Where are all the foreclosures? Certainly not in Snohomish County. As a matter of fact, Snohomish County is holding up pretty well. There has been no flood of foreclosures or bank owned properties known as REO's to come on the market.

In fact the number of REO properties sold on the market in April 2010 exceeded the number of actual foreclosures for the same period.

For the 10 months shown in the graph above there were 1,851 foreclosures. Of those, 1,387 were sold on the open market. Approximately 10% sell at auction on the courthouse steps and the rest are listed for sale.

Currently there are 409 REO properties listed for sale, which is about a 3 month supply based on current sales rates of about 139 per month.

The Snohomish County real estate market continues to show stabilization along with median and average home prices.

Tuesday, May 4, 2010

Snohomish County Foreclosures Rates April 2010

A secondary reason is most likely "strategic defaults". Those are homeowner's willing to walk away from properties which they owe more than they are worth. Many are realizing that sacrificing their credit for a couple of years is worth it. Many homeowners are more than $100,000 underwater in their homes. These are mostly homes that were purchased at the peak of the market in 2006 and 2007.

Tuesday, April 13, 2010

The 3 Most Overlooked Tax Deductions For Home Buyers

· Home Mortgage Interest

· Real Estate Taxes

But did you know that there are 3 MORE VERY IMPORTANT ADDITIONAL tax deductible items that are usually overlooked?

These are 3 important deductions that every homebuyer needs to know!

1. Points Paid By Seller (for borrower):

Well according to the IRS, their position is this:

“A borrower is treated as paying any points that a home seller pays for the borrower’s mortgage”

The term “points” is used to describe certain charges paid, or treated as paid, by a borrower to obtain a home mortgage. Points also may be called loan origination fees, maximum loan charges, loan discount, or discount points.

If you purchased a home and the seller paid “points”, these are fully deductible to you as the homebuyer! They are not deductible to the home seller.

Important Exception: The points were not paid in place of amounts that ordinarily are stated separately on the settlement statement, such as appraisal fees, inspection fees, title fees, attorney fees, and property taxes. Also, the deduction cannot exceed the amount of money you used as down payment, earnest money or other contribution totals.

Tip: Make sure your lender/escrow doesn’t apply the seller paid points directly to charges such as appraisal fees, credit reports, document preparation fees, etc. The amount is clearly shown on the settlement statement (such as the Uniform Settlement Statement, Form HUD-1) as points charged for the mortgage. The points may be shown as paid from either your funds or the seller's.

2. Mortgage Insurance Premiums: New IRS Effective Rule January 1, 2007

You can take an itemized deduction on Schedule A (Form 1040), line 13, for premiums you pay or accrue during 2009 for qualified mortgage insurance in connection with home acquisition debt on your qualified home.

Those that had to pay an up front Mortgage Insurance Premium at closing are allowed to claim that amount as a deduction.

Important Exception: If your adjusted gross income (AGI) on Form 1040, line 38, is more than $100,000 ($50,000 if your filing status is married filing separately), the amount of your mortgage insurance premiums that are deductible is reduced and may be eliminated. See Line 13 in the instructions for Schedule A (Form 1040) and complete the Qualified Mortgage Insurance Premiums Deduction Worksheet to figure the amount you can deduct. If your AGI is more than $109,000 ($54,500 if married filing separately), you cannot deduct your mortgage insurance premiums.

Tip: Don’t forget to deduct the mortgage insurance premium included in your mortgage payment every month at the end of the year as well, and for the years to come.

3. Late Charges on Mortgage Payments:

You can deduct as home mortgage interest a late payment charge if it was not for a specific service in connection with your mortgage loan.

Advice: Please consult your tax accountant for advice regarding restrictions and limitations for your personal situation.

Thursday, April 8, 2010

Snohomish County Average Home Prices March 2010

Snohomish County average homes prices for March 2010 were $308,299. Average home prices so far this year are:

Snohomish County average homes prices for March 2010 were $308,299. Average home prices so far this year are:January $310,883

February $312,299

March $308,299

Prices look like they are "bouncing around the bottom". However, prices remain under pressure with bank sales and short sales. We will need to watch how the expiration of the home buyer credits, increased interest rates and more foreclosures coming on the market affect prices in the coming months

Keep in mind that these statistics are all about homes that are selling. Home sale averages are weighted heavily by sales under the $400,000. This doesn't necessary mean that home prices are still falling... it means more homes are selling in the lower price ranges.

By looking at the chart below you can see that the majority of home sales are under $300K. With so many home sales in the lower price range and few homes sold above $500K, will drag down the average.

Those looking to sell a home above $500K will find few buyers.

Monday, April 5, 2010

King County Average Home Prices March 2010 Show Continued Market Stabilization

King County Foreclosure Rates March 2010

Banks have been scrambling to hire thousands of employees to help process the backup of loan modifications applications, as well as stream line their computerized systems to meet demand.

Their are several programs now available to help those in financial distress.

The HAMP Program. This program can reduce your interest rate to as low as 2%. As of March 26th, 2010, President Obama updated the plan to include those that are unemployed.

The HAFA Program. This program is available for homeowners who: 1. do not qualify for a trial mortgage modification under the Making Home Affordable Program; 2. do not successfully complete the trial period for their modification; 3. miss at least two consecutive payments during their modification period; or 4. request a short sale or deed-in-lieu of foreclosure.

Also be aware that all these programs are FREE. You should never pay anyone a cent for a loan modification. Your current mortgage holder processes your application for FREE.

If you need some guidance on these or other programs, give us a call, we can help.

Friday, April 2, 2010

Snohomish County Foreclosure Rates March 2010

Snohomish County foreclosures rates for March 2010 were 217 homes. The uptick in Notice of Trustee sales for March 2010 indicates many homeowners are still struggling to meet their mortgage obligations.

Snohomish County foreclosures rates for March 2010 were 217 homes. The uptick in Notice of Trustee sales for March 2010 indicates many homeowners are still struggling to meet their mortgage obligations.The Hamp Program (Making Home Affordable Program) specifically designed to help these homeowners is working for some. Banks are painfully slow in processing the applications, which can take 6 months to a year or more to complete.

New programs are being unrolled as well which will include mortgage balance reductions and Short Sales under the HAFA Program.

This area of the market is changing daily. Bank of America recently introduced a Principal Forgiveness Plan to enhance it's National Homeownership Retention Program. It will systematically lower the principal balance on some mortgages. More banks are likely to follow.

Last week, the Obama adminstration announced that the HAMP program should be extended to those that are unemployed. The Wall Street Journal's recent article states "The revisions, which will also include temporary help for unemployed borrowers, serve as a recognition that the administration 's foreclosure rescue plan hasn't kept pace with the rising number of souring loans."

Programs are constantly changing, sometimes daily. If you or someone you know is struggling to meet their mortgage obligations, give us a call and we can direct you to all the current resources that are available.

Wednesday, March 10, 2010

Snohomish County Average Home Prices Remain Stable For February 2010

Click on graphs to enlarge

Click on graphs to enlargeSnohomish County average sales prices remained stable for February 2010. Prices have remained between $310,000 and $315,000 for the last 6 months, which is a good indicator of market stablization.

Currently listing activity (residential only) shows 3,893 homes. Of those, 761 are short sales and 311 are bank owned properties.

Friday, February 12, 2010

Snohomish County Foreclosures January 2010

We hope the banks are finally see the light "loan modifications cost less money than foreclosures"!

Tuesday, January 26, 2010

Bank Foreclosures Absorbed Into Market Sales - No Excess Inventory

Current statistics show that for the last 6 months of 2009, most bank foreclosed properties that came on the market were sold through the Northwest Multiple Listing Service.

Current statistics show that for the last 6 months of 2009, most bank foreclosed properties that came on the market were sold through the Northwest Multiple Listing Service.The Snohomish County Treasurer reported 1,155 foreclosures and the Northwest Multiple Listing Service showed 920 bank properties sold in the same period of time. Adjusting for the few that are sold through auction, left us a total of only 185 unsold for the end of the year.

The numbers show that approximately 153 bank owned properties were sold per month on average leaving slightly more than one month of standing inventory of bank owned properties.

Average days on market for residential properties was 57 and they sold for 98.6% of asking price. Current statisics show that for the last 6 months of 2009, most bank foreclosed properties that came on the market were sold through the Northwest Multiple Listing Service.

The Snohomish County Treasurer reported 1, 155 foreclosures and the Northwest Multiple Listing Service showed 920 bank properties sold in the same period of time. Adjusting for the few that are sold through auction, left us a total of only 185 unsold for the end of the year.

The numbers show that approximately 153 bank owned properties were sold per month on average leaving slightly more than one month of standing inventory of bank owned properties.

Average days on market for residential properties was 57 and the and they sold for 98.6% of asking price.

Bank Foreclosures Absorbed Into Market Sales - No Excess Inventory

Monday, January 25, 2010

Snohomish County Foreclosure Rates For 2009

The foreclosure rates for Snohomish County dropped off during the holidays to their lowest levels of the year. However, Notice of Defaults remain steady at around the 400 mark. This tells us that about 25% of the homes that are delinquent on their mortgage turn in to actual foreclosures.

Many distressed homeowners are either applying for home loan modifications through the Making Home Affordable plan put in place by President Obama or are attempting to sell their homes before a foreclosure takes place through a "short sale". A short sale is a transaction where the home sells for less than what is owned on the mortgage.